Effective tax rate formula

Truth-in-taxation requires most taxing units to calculate two rates after receiving a certified appraisal roll from the chief appraiser the no-new-revenue tax rate and the voter-approval tax rate. To calculate your overall tax rate the following formula is used.

Income Tax Formula Excel University

The formula for tax multiplier can be derived by using the following steps.

. For example a nominal interest rate of 6 compounded monthly is equivalent to an effective. VLOOKUP requires lookup values to be in the first column of the lookup table. At this point lets take note of the difference between the proposed effective tax rate of 25 and our calculated effective tax rates.

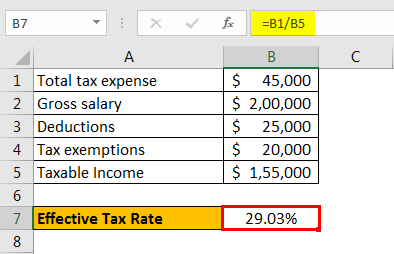

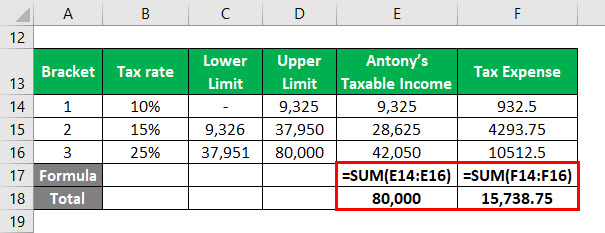

Because the first column in the example is actually Band we are. Uses the formula described in the third column to determine his federal income tax. John joined a bank recently where he earns a gross salary of 200000 annually.

The effective interest rate is calculated as if compounded annually. Benefit Ratio X Reserve Factor Social Cost. EIR or effective interest rate is meant to reflect the true cost of taking a loan in Singapore.

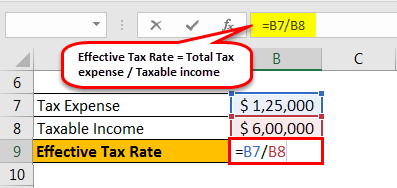

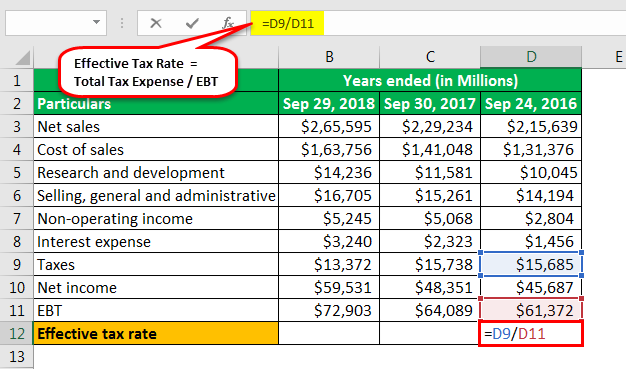

The effective tax rate in G7 is total tax divided by taxable income. The effective annual interest rate is the interest rate that is actually earned or paid on an investment loan or other financial product due to the result of. For both there is a similar formula only with variation in considering variables.

The effect of a tax shield can be determined using a formula. What does Effective Interest Rate EIR mean. Cities counties and hospital districts may levy a sales tax specifically to reduce property taxes.

The effective rate is calculated in the following way where r is the effective annual rate i the nominal rate and n the number of compounding periods per year for example 12 for monthly compounding. Discount Rate 698. Basic Tax Rate calculation with VLOOKUP.

Let us take the example of John to understand the calculation for the effective tax rate. Interest Tax Shield Example. Let us now take an example with multiple future cash flow to illustrate the concept of a discount rate.

If you mail or fax the registration form you will receive a notice of your new employer tax rate in the mail. If you register on-line the tax rate assigned will become effective after it has been reviewed by the department. Tax Rate 2083.

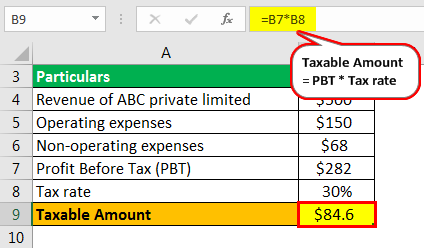

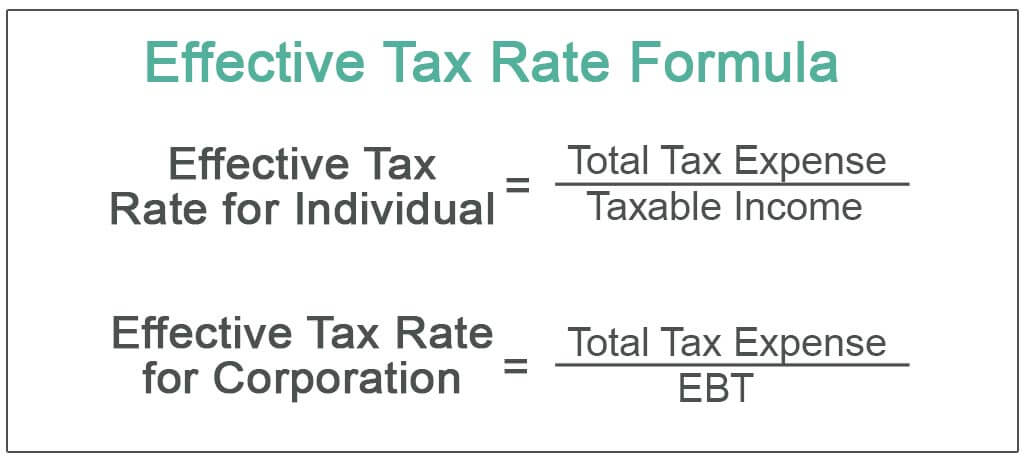

The effective tax rate formula for corporation Total tax expense EBT read more. There is a complex relationship between taxable income and actual income making it difficult to draw conclusions from the tables. 1 The type of taxing unit determines which truth-in-taxation steps apply.

To learn more launch our free accounting and finance courses. The total amount paid in taxes in 2021 and your taxable income in the same year. Tax Shield Deduction x Tax Rate.

Therefore the effective discount rate for David in this case is 698. To calculate your effective tax rate you need two numbers. Assume for example that Taxpayer A is single and.

A company carries a debt balance of 8000000 with a 10 cost of debt and a 35 tax rate. In our scenario 17000 of their withdrawal is non-taxable cost basis the other 68000 falls into the 0 tax bracket leaving them with a federal income tax bill of 0 and an effective federal tax rate of 0. Firstly determine the MPC which the ratio of change in personal spending consumption as a response to changes in the disposable income level of the entire nation as a whole.

Effective tax rate Effective Tax Rate Effective tax rate determines the average taxation rate for a corporation or an individual. Most importantly though it looks at how long the. G5 inc returns 137.

The tax rate schedules give tax rates for given levels of taxable income. B5 rate If FALSE the formula applies the tax. Discount Rate Formula Example 3.

Thats because the loan interest rate is not the only cost. There are often also other costs such as the administration fee that a bank may charge. Effective Annual Interest Rate.

Average rate at which a firm is taxed on itss. This is usually the deduction multiplied by the tax rate.

Effective Tax Rate Definition Formula How To Calculate

Effective Tax Rate Definition Formula How To Calculate

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula And Calculation Example

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Excel Formula Income Tax Bracket Calculation Exceljet

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Definition Formula How To Calculate

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Formula Calculator Excel Template

Effective Tax Rate Definition Formula How To Calculate

Federal Income Tax Calculating Average And Marginal Tax Rates Youtube

Effective Tax Rate Formula And Calculation Example

How To Calculate The Asc 740 Tax Provision Bloomberg Tax

/dotdash_Final_Tax_Equivalent_Yield_Nov_2020-01-c528a1d54d4f48f19113104ac3291de1.jpg)

Tax Equivalent Yield Definition

Cost Of Debt Kd Formula And Calculator Excel Template